The Retail Gravity Trap: Why Chasing Channels Costs Brands Their Future

There is a particular kind of strategic confusion that happens when retail executives attend conferences. They hear about TikTok Shop driving $33 billion in global sales. They listen to PayPal executives discuss agentic AI creating a $5 trillion opportunity by 2030. They take notes about Aldi opening 180 stores while acquiring 17 million new customers.

Then they return to their offices and make the same structural mistakes that cause brands to fail.

The Viral Trap

TikTok Shop's numbers are seductive. PacSun sold 11,000 pairs of Casey jeans on a single Black Friday after one influencer post went viral. Crocs became the platform's top footwear brand within months of joining, with one live shopping event generating $1 million in sales - a 28,300% increase over baseline.

The platform's creator ecosystem has grown 1,400% in two years. Health and beauty alone drove $1.34 billion through the channel in 2024. These are real numbers representing real revenue.

But something changed by late 2024. TikTok pulled back organic reach. The viral-for-free era ended. Brands that built success on organic discovery now face pay-to-play dynamics. The channel that seemed like a shortcut to growth became another line item in the customer acquisition budget.

This pattern should look familiar. It happened with Facebook. It happened with Instagram. It happened with Google organic search. Every platform follows the same arc: free discovery attracts brands, brands attract consumers, consumer attention becomes the product, and brands pay to reach the audiences they helped build.

The Automation Mirage

Meanwhile, the agentic AI conversation has shifted from science fiction to boardroom strategy. McKinsey projects $5 trillion in agentic commerce by 2030. Holiday 2025 surveys show somewhere between 33% and 83% of shoppers used AI for purchase research - the variance itself revealing how poorly we measure this shift.

But at NRF, when retail executives were asked whether they would trust AI to complete a transaction, only about half raised their hands. These are the people building the systems.

PayPal's VP of Agentic Commerce, Mike Edmonds, put it directly: "I'm under no false illusion that shopping one day will be completely autonomous and humans will stop interacting with brands." Low-consideration items like paper towels might shift to agent-to-agent transactions. High-consideration purchases will stay with humans.

Fabletics President Meera Bhatia noted that customers still visit their site directly for "reviews and product photos and influencer content." The rich brand experience that converts shoppers cannot yet be replicated by AI platforms. Tracking and attribution remain underdeveloped.

The technology is advancing faster than consumer trust. Brands preparing for fully autonomous shopping may be optimizing for a future that arrives much later than projected - or arrives in a form unrecognizable from current predictions.

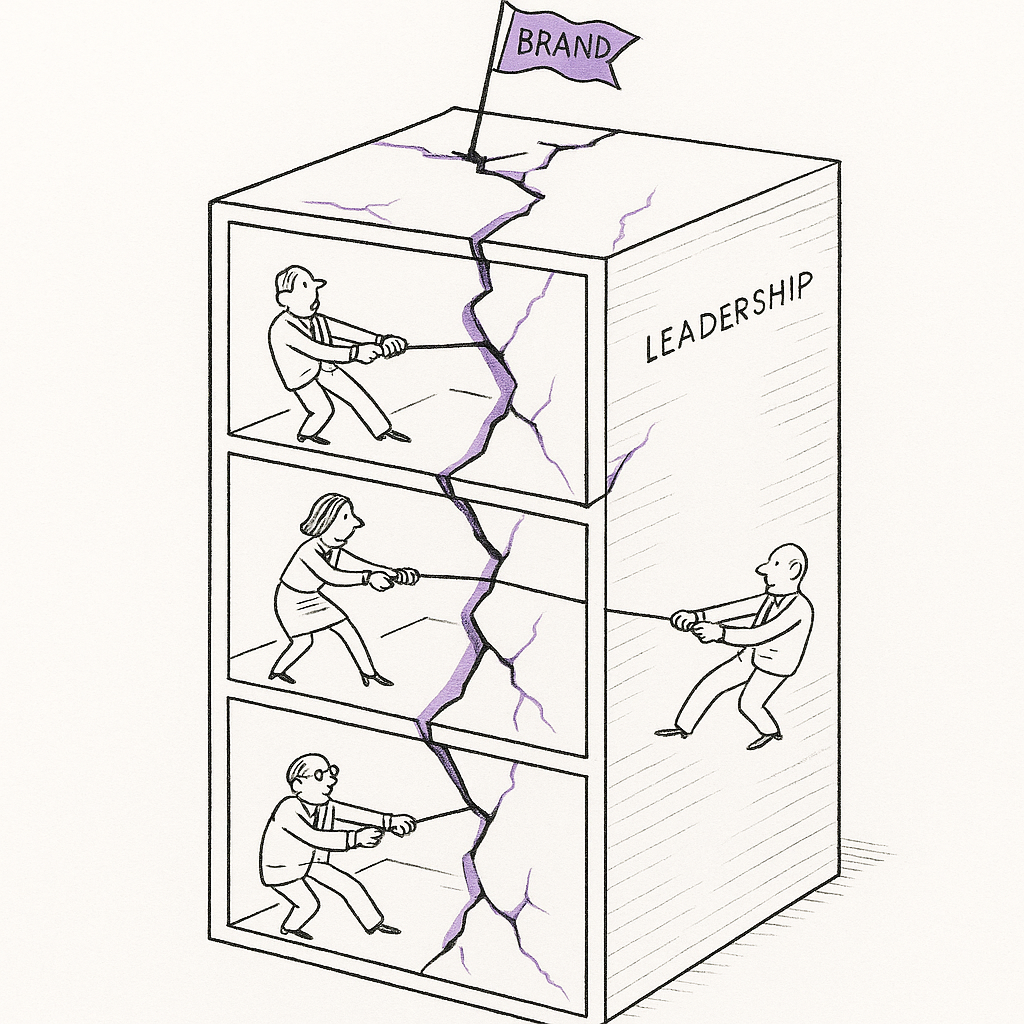

The Structural Reality

While executives chase the next channel and the next technology wave, Branding Strategy Insider identified the actual reasons brands fail to grow. The causes are structural and internal: organizations lack adequate comprehension of what brands do, underinvest in brand maintenance while pursuing acquisition, and operate with disconnects that prevent integrated strategy.

These are not market problems. They are organizational problems. And they persist across business cycles, technology shifts, and competitive disruptions.

Aldi's expansion offers a contrasting case study. While other retailers chase viral moments and AI integration, Aldi has committed to opening 180 stores across 31 states in 2026. Their approach relies on simplified operations, consistent value positioning, and systematic market expansion. No viral dependency. No technology bet. Just disciplined execution of a clear strategy.

The results: 17 million new customers in 2025, grocery visit share growing from 4.3% to 5.7%, customer savings of $8.3 billion annually. Their 50th anniversary in America arrives with a path to 3,200 stores by 2028.

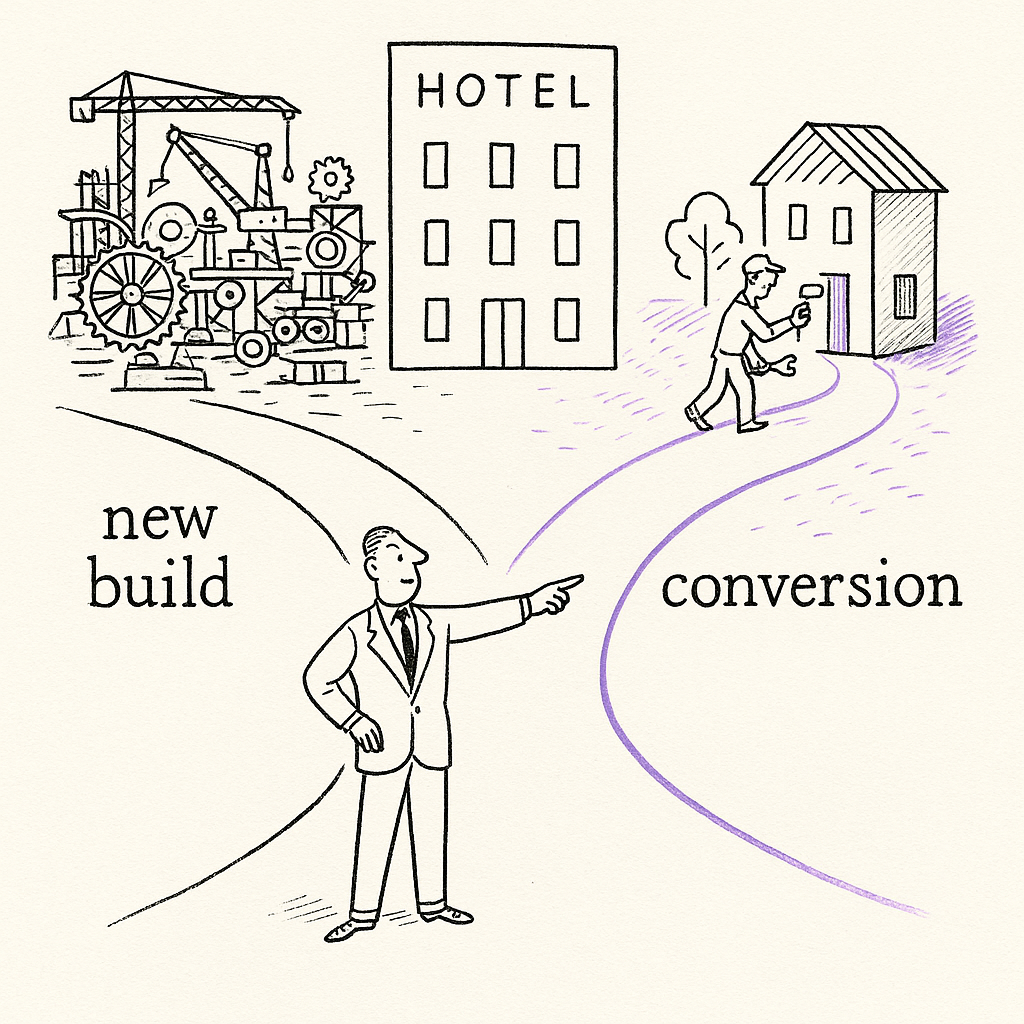

The Hotel Industry Parallel

Hotel development executives, facing their own strategic confusion, have arrived at an instructive conclusion. At recent industry gatherings, leaders from Marriott, Hilton, and Hyatt described a shift toward conversions over new construction. Construction costs remain elevated with no expected reduction in labor, materials, or land. Lending requires stricter financial discipline.

The response has not been to chase the newest technology or the hottest market. Instead, they are converting existing properties faster - 40-50% faster time-to-opening than new builds, with 30-50% lower capital requirements. Major brands are launching conversion-friendly collection brands specifically designed for this reality.

754 new hotels will open in 2026. But the strategic insight is not in the expansion - it is in how that expansion happens. Disciplined, realistic, based on clear paths to returns rather than optimistic projections about market trends.

What Actually Works

The synthesis across these developments reveals something uncomfortable for executives returning from conferences with notebooks full of trending topics.

TikTok Shop works until it does not. The brands succeeding there built genuine cultural relevance - PacSun with influencer authenticity, Crocs with product distinctiveness - not just platform presence. When organic reach disappears, brands without real differentiation become commodity advertisers.

Agentic AI will transform some purchase categories while leaving others untouched for years. The brands preparing for this are not abandoning human connection - they are investing in the rich content, reviews, and experiences that AI platforms cannot yet replicate. They are maintaining merchant-of-record status rather than delegating to intermediaries.

And beneath both trends, the structural work of brand building continues to matter more than channel tactics. Organizations that understand their brand, invest in its maintenance, and align internally around clear strategy will outperform those chasing each new discovery mechanism.

Aldi does not need TikTok Shop virality. They need 180 well-located stores with consistent value propositions. Hotel developers do not need revolutionary technology. They need realistic financial projections and operational discipline.

The gravity trap in retail is not any single channel or technology. It is the belief that the next platform will solve the structural work that brands have always needed to do.

Sources

- For retail brands, TikTok Shop's rise brings viral success - and disruption - Retail Dive

- Brands Briefing: How leaders at Fabletics, PayPal and more are thinking about the agentic AI opportunity - Modern Retail

- The Structural Reasons Brands Fail To Grow - Branding Strategy Insider

- Aldi: The Robin Report Retail Hit of the Week - The Robin Report

- C-suite leaders forecast the top hotel development trends of 2026 - Hotel Dive