The Great Replacement: What AI's Sales Team Takeover Means for Brand Partnerships

Jason Lemkin did something most executives only whisper about in private. When his last salesperson quit, he didn't hire a replacement. He deployed 20 AI agents instead.

The result: work that previously required 10 SDRs and account executives now runs on 1.2 humans managing AI systems. Lemkin predicts most sales development reps will be "extinct within a year."

This sounds like a tech industry story. It's actually a preview of how every brand partnership - including local activation deals - will be discovered, evaluated, and maintained in the next few years.

The Partnership Discovery Problem

Brand managers face a version of the same challenge Lemkin solved. Finding the right local partners - coffee shops, gyms, retail stores - requires the same grinding work as traditional sales prospecting: researching candidates, evaluating fit, making initial contact, nurturing relationships.

Most brands either throw money at national influencer deals (measurable but impersonal) or rely on regional teams making gut-feel decisions about local partnerships (authentic but unscalable). Neither approach works well.

The SaaStr experiment suggests a third path. What if AI agents could handle the prospecting and initial qualification of local partners, while humans focused on relationship building and strategic decisions?

The economics make sense. If 20 agents can replace 10 salespeople for prospecting, the same ratio probably applies to partnership development. A brand that previously evaluated 50 potential local partners per quarter could evaluate 500 - with the same team.

Content Licensing Shows the Model

The publishing industry spent 2025 figuring out how to work with AI companies rather than against them. The deals that emerged offer a template for how brand partnerships might evolve.

OpenAI, Google, Amazon, and Microsoft signed dozens of content licensing agreements with publishers. The structures varied - OpenAI's "all you can eat" arrangements versus Microsoft's "a la carte" pay-per-use marketplace - but the pattern was consistent: publishers provided content access in exchange for compensation, attribution, and AI tools.

The interesting detail is how these deals enabled new products. The Washington Post and New York Times content now powers Amazon's shopping assistant Rufus. Condé Nast and Hearst content trains systems that recommend products based on editorial context.

For brands, this suggests that the value of a local partner isn't just foot traffic or Instagram posts - it's data and context. A coffee shop partnership might eventually be valuable not because 500 people see your brand on the counter, but because you learn what those 500 people order, when they come in, and what they care about.

The question becomes: what's the "content licensing deal" equivalent for local partnerships?

Experiences Replace Amenities

Meanwhile, luxury hotels are abandoning the amenity arms race. According to Skift's analysis of 2026 hospitality themes, high-end properties are competing less on room features (which have converged at similar quality) and more on exclusive experiences.

Rosewood now sells "discovery and cultural immersion" alongside accommodations. Mandarin Oriental focuses on "spontaneous moments" rather than standardized perks. Marriott extends loyalty into everyday retail through partnerships.

The numbers are striking: 83% of Minor Hotels customers consider local immersion important when choosing destinations. 85% actively seek place-tied experiences.

This matters for brand partnerships because it validates the premise that local authenticity has real economic value. When guests specifically seek "place-tied experiences," they're essentially asking for the opposite of standardized national marketing. They want something that could only happen here - which is exactly what good local partnerships provide.

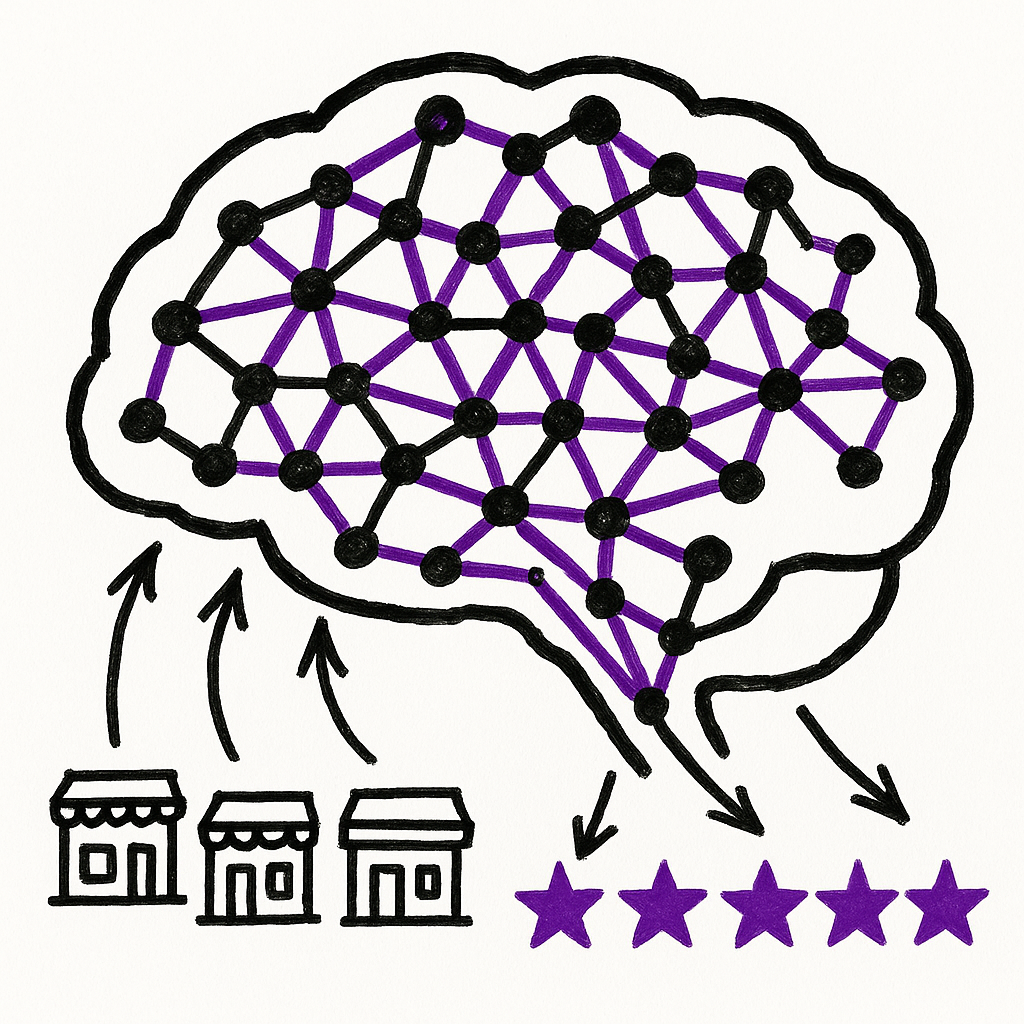

The Intelligence Layer

Here's where it gets interesting. The same AI advances that enable Lemkin's agent-driven sales team also make partnership evaluation more rigorous.

The State of LLMs in 2025 highlighted several shifts that matter here. Training costs dropped from an assumed $50-500 million to approximately $5 million, democratizing access to sophisticated AI. New techniques like inference-time scaling let organizations allocate compute budgets for accuracy over speed - exactly what you'd want for evaluating potential partners.

Most significantly, tool-integrated AI systems reduce hallucinations substantially. The emerging MCP (Model Context Protocol) standard enables systems to pull real data rather than generating plausible-sounding fiction.

Apply this to partnership decisions. Instead of relying on a regional manager's impression of whether a coffee shop has "good vibes," you could have AI systems that:

- Cross-reference owner backgrounds against brand values

- Analyze customer review sentiment for authenticity signals

- Map foot traffic patterns against your target demographics

- Score credibility indicators that predict partnership success

This isn't theoretical. The technology exists. The question is who builds it for brand partnerships specifically.

The Skeptic's Take

Let me be direct about the uncertainties here. Lemkin's experiment worked for SaaS sales, which has clear metrics and digital touchpoints. Local partnerships involve physical spaces, human relationships, and community dynamics that resist easy quantification.

The publisher-AI deals remain contentious. Multiple lawsuits challenge AI training practices, and we don't know yet whether these arrangements will prove durable. They might represent the future of content partnerships or an awkward transition phase.

And the luxury hotel trends, while interesting, reflect preferences among high-net-worth travelers - not necessarily the broader consumer base that most brand partnerships target.

Still, the direction seems clear. AI is getting better at the research and evaluation tasks that currently bottleneck partnership decisions. The brands that figure out how to harness this for local activation will move faster than competitors still relying on gut feel and spreadsheets.

What This Means for 2026

If you're evaluating local partnership opportunities, three implications stand out:

First, partner data becomes strategic. The value of a local partnership increasingly includes the context and signals you gather - not just the activation itself. Design partnerships that generate useful intelligence, not just brand impressions.

Second, quantity becomes feasible. AI-powered prospecting means you can evaluate many more potential partners than before. The constraint shifts from "how many can we research?" to "how do we prioritize the most promising opportunities?"

Third, authenticity still wins. All this AI capability serves one purpose: finding partners who genuinely align with your brand and audience. The technology makes discovery more efficient, but human judgment still determines which relationships are worth building.

The brands that thrive won't be the ones that fully automate partnership decisions. They'll be the ones that use AI to see more options and make better-informed choices - while keeping humans at the center of relationships that matter.

Sources

- We replaced our sales team with 20 AI agents—here's what happened - Lenny's Newsletter

- A timeline of the major deals between publishers and AI tech companies in 2025 - Digiday

- 5 Luxury Hotel Themes for 2026 - Skift

- The State Of LLMs 2025: Progress, Problems, and Predictions - Ahead of AI

Hass Dhia is Chief Strategy Officer at Smart Technology Investments, where he helps brands find authentic local activation partnerships powered by neuroscience and AI. He holds an MS in Biomedical Sciences from Wayne State University School of Medicine, with thesis research in neuroscience.