The Real Premium: Why Price Tolerance Follows Participation

ITC Hotels just reported something that breaks conventional pricing wisdom. They raised average daily rates by 9% - and occupancy went up 2.9%.

That's not supposed to happen. In economics textbooks, higher prices mean lower demand. But in hospitality - and increasingly across experiential industries - the relationship inverts when one condition is met: genuine participation.

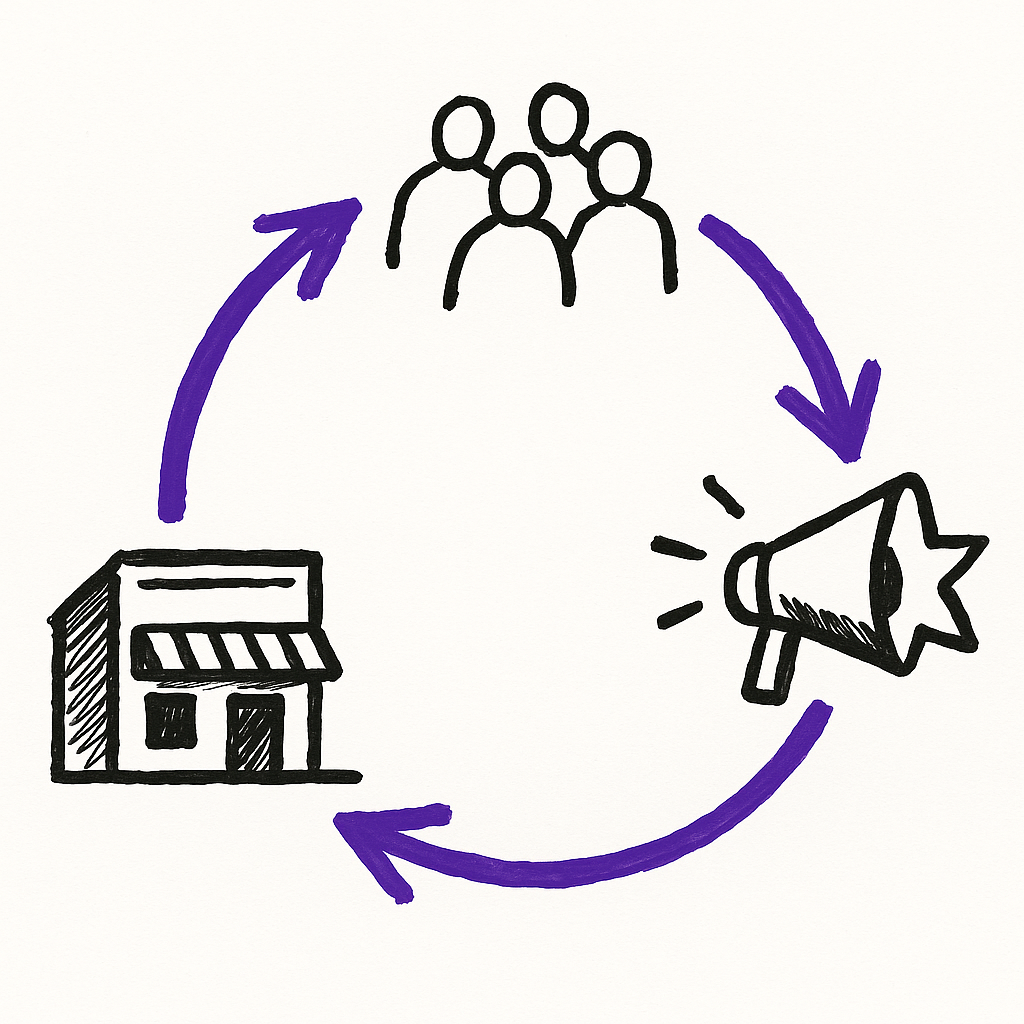

The same week, Digiday announced its European marketing awards finalists. The standout campaigns shared a common thread. Coca-Cola transformed Madrid into a "citywide feed" by extending TikTok content into physical billboards with QR codes. Volkswagen's winning approach wasn't digital efficiency - it was helping sales advisors maintain personal connection through digital tools. The awards judges seemed to notice what ITC Hotels discovered: people pay premiums for participation, not just products.

The 48x Engagement Gap

The Financial Times published a remarkable stat: their comment writers are 48 times more engaged than average readers.

Not 48% more engaged. Forty-eight times. That's not a marginal improvement to optimize for - it's a completely different category of relationship.

This isn't about comments specifically. Publishers are discovering that any "recurring, participatory touchpoint where readers contribute signals" - polls, Q&As, direct feedback - creates readers who behave entirely differently than passive consumers. These aren't customers anymore. They're participants.

The implication for brand activations is direct. When someone comments, votes, or shows up to an event, they've crossed a line from audience member to participant. And participants demonstrate price tolerance that passive consumers don't.

Why Premium Pricing Works After Participation

ITC Hotels isn't competing on room rates. They're expanding into weddings, events, and MICE (meetings, incentives, conferences, exhibitions). These aren't customers comparing prices on booking sites - they're participants planning milestone moments.

The hotel chain maintains a 48% RevPAR premium over industry averages. That's only possible because their customer base isn't comparing them to the cheapest alternative. They've moved into a category where the relevant comparison is "will this venue make our wedding memorable" rather than "which hotel is cheapest."

True Religion's CMO Kristen D'Arcy made a similar observation in a recent AdExchanger interview. She's moved away from last-click attribution because it doesn't capture what actually drives purchases. "Measurement, like buying jeans, is about finding the right fit," she explained. The metrics that matter for a premium denim brand aren't the same metrics that matter for commodity goods.

The connecting principle: when customers participate - whether that means attending events, engaging with content, or being part of a community - they're no longer comparing you to alternatives on price. They're evaluating you on whether you're worth their participation.

Local Activation as Participation Engine

This explains why local brand activations work when they work - and why they fail when they fail.

A brand that sponsors a local coffee shop's Instagram post is buying advertising. A brand that co-hosts a community event with that coffee shop is buying participation. The first creates awareness. The second creates the 48x engagement gap the FT documented.

Coca-Cola's Madrid activation understood this. They didn't just buy billboards - they turned billboards into participation prompts with QR codes that let people interact with creator content. The physical presence wasn't the ad; it was the participation trigger.

ITC Hotels' expansion strategy follows the same logic. They're not building rooms in Tier-2 and Tier-3 cities because those cities need more hotel beds. They're building venues for participation - weddings, conferences, milestone events - in markets underserved by premium experiential options.

The Skeptic's Question

Here's where healthy skepticism is warranted: can this actually be measured?

True Religion's CMO explicitly said she's moved beyond last-click attribution. The FT engagement stat sounds impressive, but it's unclear what "48 times more engaged" actually means for revenue. ITC Hotels' results are strong, but hospitality has structural tailwinds in India that might explain performance regardless of strategy.

The honest answer is that participation-driven pricing exists in a measurement gray zone. Companies that rely on it tend to measure leading indicators (engagement, participation rates, community activity) and trust that revenue follows. Companies that demand attribution for every dollar often optimize away the participation mechanisms that create premium tolerance in the first place.

Volkswagen's approach is instructive here. They didn't digitize the car-buying process for efficiency - they digitized it to maintain human connection. The "personalized brochures" that won Digiday recognition aren't about conversion optimization. They're about preserving "advisor relationship energy" beyond the dealership. That's hard to A/B test, but dealers seem convinced it works.

What This Means for Brand Partnerships

If participation creates price tolerance, then brand partnerships should be evaluated on participation generation, not just reach or impressions.

A local barbershop that hosts brand events creates participants. A local barbershop that displays brand posters creates impressions. The first relationship is worth a premium. The second is a commodity.

This doesn't mean every activation needs to be an event. The Financial Times' comment writers aren't attending FT conferences - they're typing responses to articles. The participation threshold is lower than it seems. But it does mean that passive placement and active participation live in different strategic categories entirely.

For brands evaluating local partnerships: the question isn't "how many people will see this?" The question is "how many people will participate in something?" The ITC Hotels data suggests that participants tolerate - even expect - premium pricing in ways that passive consumers don't.

Hass Dhia is Chief Strategy Officer at Smart Technology Investments, where he helps brands find authentic local activation partnerships powered by neuroscience and AI. He holds an MS in Biomedical Sciences from Wayne State University School of Medicine, with thesis research in neuroscience.

Sources

- ITC Hotels Pushes Ahead With Asset-Light Strategy as Weddings and Events Drive Revenue - Skift

- Sizing Up Success Metrics, With The CMO Of True Religion - AdExchanger

- How publishers leverage community as a personalization and revenue tool - Digiday

- Coca-Cola, DIVE, Tribal Worldwide London, Volkswagen, Paper Crowns and Logitech G are Digiday Marketing and Advertising Awards Europe finalists - Digiday